Buying property in Dubai

Buying property in Dubai, as one of the most booming real estate markets in the Middle East, has attracted the attention of many international investors and buyers.

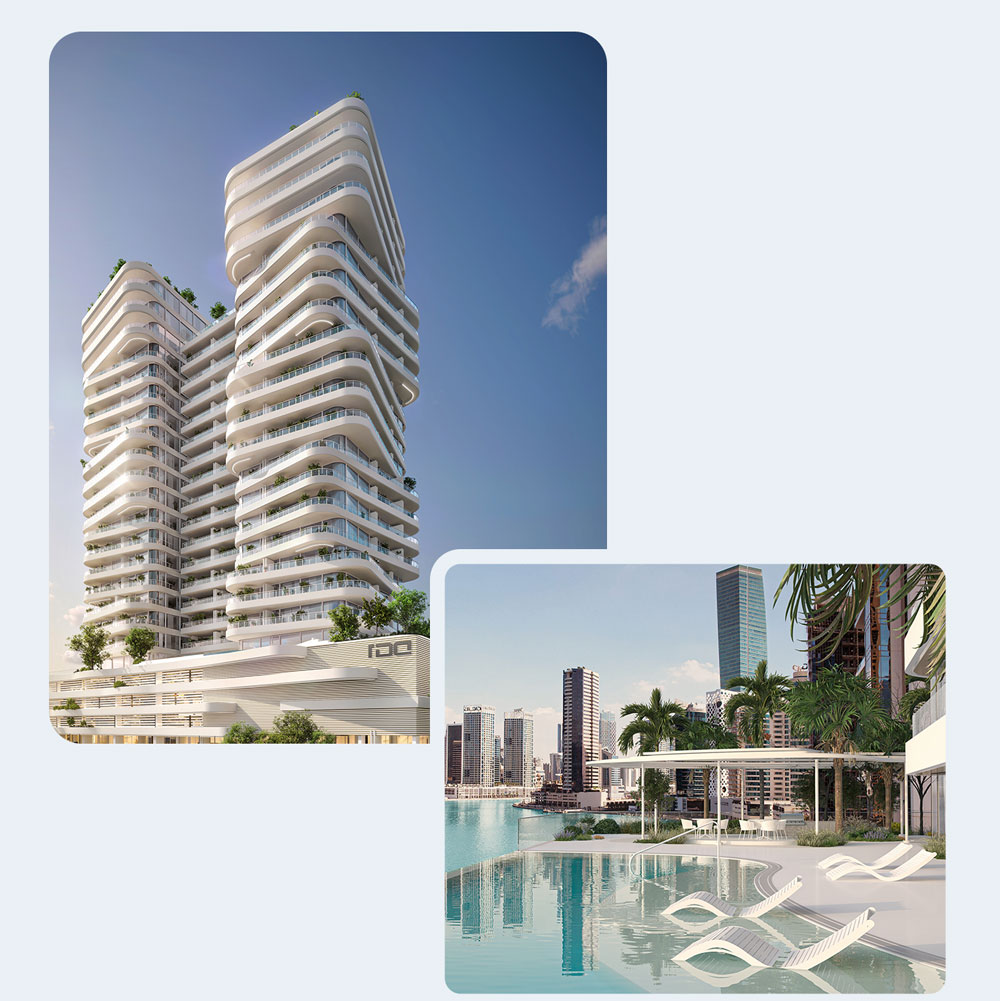

Profitable investment

Buying property in Dubai

Buying property in Dubai, as one of the most booming real estate markets in the Middle East, has attracted the attention of many international investors and buyers. With transparent laws and various benefits, including the absence of direct taxes on residential properties, buying a house in Dubai has become one of the most attractive choices for investors and people looking for a new home. This article will help you familiarize yourself with the rules and procedures for buying property in Dubai, the benefits and important points along the way. We will also examine the types of property ownership and the different methods of buying houses in Dubai. Stay with us to get complete and accurate information in this regard.

Projects

Benefits of buying property in Dubai

Buying property in Dubai has many advantages. Some of these advantages include

No tax on residential property

Dubai remains one of the few cities that does not have a direct tax on residential property, making it an attractive destination for investors.

Residence visa for investors

Foreign nationals who invest at least AED 1 million in Dubai real estate can obtain a three-year residency visa. For larger investments (AED 2 million and above), five- or ten-year visas are also available.

Advancement of urban infrastructure and facilities

With modern infrastructure including major roads, advanced public transportation, and access to amenities, Dubai is considered one of the best places to live and invest.

Types of ownership in Dubai (freehold and leasehold)

The main difference between freehold and leasehold is that freehold allows you to own the property outright and there are no restrictions on selling, renting or altering the property. In contrast, with leasehold you can occupy the property for a fixed period of time, usually up to 99 years. This type of ownership is particularly attractive to foreigners looking for long-term investment, but it does not allow them to transfer ownership completely.

Steps to buying property in Dubai

To buy a house in Dubai, you need to follow a few important steps

Preparing a purchase or sale agreement

After selecting the property, you need to negotiate with the seller and determine the terms of buying the property in Dubai. This agreement should be carefully drafted and include details of the price, payment methods and related conditions. There is no need for a lawyer or real estate agent at this stage; however, it is recommended to use the help of reputable real estate agents.

Signing the sales contract

After final agreement, download the sales contract, also known as the “Memorandum of Understanding” (MOU) or Form F, and sign it with the seller in the presence of a witness. You will also need to pay 10% of the property price as a deposit to the Registrar of Deeds, which will be returned to you after the transaction is completed.

Obtain a No Objection Certificate (NOC)

To transfer ownership, you need to obtain a No Objection Certificate from the developer. This certificate is issued if the property has no debts or service charges.

Transfer of ownership at the registry office

At this stage, you prepare the required documents and go to the registry office with the seller to transfer ownership. After the documents are approved and the fees are paid, a new title deed will be issued in your name.

Buying property from developers: Freehold and Off-plan

There are two ways to buy property from developers: freehold and off-plan. Off-plan buying involves buying a property in the early stages of development or even before construction begins, often with special discounts and flexible payment terms. In this section, we will provide a much more complete explanation of this type of property purchase in Dubai.

What is the minimum purchase amount for a property to obtain Oman residency?

By purchasing at least thirty-five thousand Omani Rials in IPC estates, you can obtain Oman residency. For more information, please contact Ms. Samaneh Boroujerdi, the manager of Samaland Real Estate Agency, for a free consultation.

Off-plan purchase

Off-plan buying is a popular investment method in the Dubai property market, allowing buyers to purchase their desired property in the early stages of construction or before its completion. This type of purchase usually comes with more attractive prices than ready-made properties and various payment plans offered by developers. The advantages of this method include the possibility of buying property in Dubai at lower prices, installment payment plans and taking advantage of special discounts.

However, off-plan buying also has its own challenges. One of the main challenges of this type of purchase is the possibility of delays in the delivery of the project. Sometimes projects encounter problems during the construction process, which may cause delays in the delivery of the property to buyers. Also, some projects may be canceled due to financial difficulties of the developer or other reasons, which can cause losses to buyers.

To ensure success in off-plan property purchases, it is advisable to conduct thorough research on the developer and the project before making a purchase. Make sure that the project is registered with the Real Estate Regulatory Authority (RERA) and the developer has a reliable track record of completing projects on time and with high quality. Also, buyers should be well aware of the terms of the contract and payment terms to avoid any unexpected problems in the future.

Another advantage of buying off-plan property in Dubai is the possibility of obtaining a residence visa for buyers. By investing in off-plan property worth at least AED 1 million, you can obtain a three-year residence visa, which is a great advantage for those looking to live or work in Dubai.

Experience the safest way to invest with Samaland